Internet and other distribution channels to individuals, businesses and institutions in states, the District of Columbia and in countries outside the United States. The Company provides consumer financial products and services including checking and savings accounts, credit and debit cards, and auto, mortgage and home equity, and small business lending. It provides other offer financial planning, private banking, investment management, and fiduciary services. The Company also provides financial solutions to businesses through products and services including traditional commercial loans and lines of credit, letters of credit, asset-based lending, trade financing, treasury management, and investment banking services. Wells Fargo is one of the oldest financial institutions in the United States.

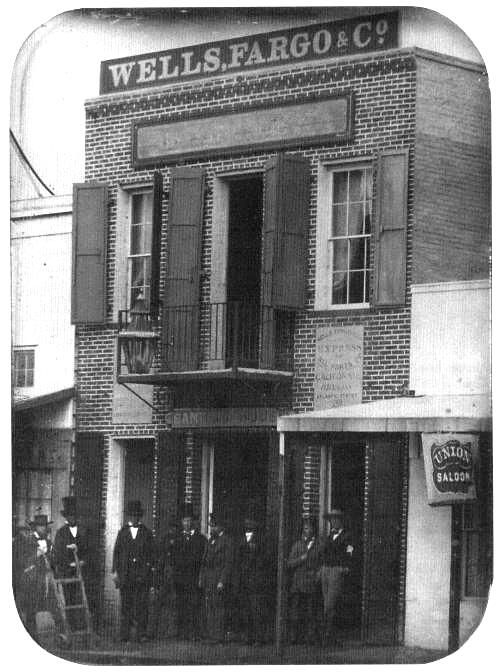

Founded in 1852, Wells Fargo has grown to become one of the largest national banks in America. Wells Fargo maintains a vast physical presence with more than 5,200 bank branches and over 13,000 ATMs spread across the U.S. The national bank is home to several checking and savings products and many other banking solutions for individuals, businesses and corporations. In September 2016, Wells Fargo was issued a combined total of $185 million in fines for opening over 1.5 million checking and savings accounts and 500,000 credit cards on behalf of customers without their consent. The Consumer Financial Protection Bureau issued $100 million in fines, the largest in the agency's five-year history, along with $50 million in fines from the City and County of Los Angeles, and $35 million in fines from the Office of Comptroller of the Currency.

The scandal was caused by an incentive-compensation program for employees to create new accounts. It led to the firing of nearly 5,300 employees and $5 million being set aside for customer refunds on fees for accounts the customers never wanted. Carrie Tolstedt, who headed the department, retired in July 2016 and received $124.6 million in stock, options, and restricted Wells Fargo shares as a retirement package. A key part of Wells Fargo's business strategy is cross-selling, the practice of encouraging existing customers to buy additional banking services.

Customers inquiring about their checking account balance may be pitched mortgage deals and mortgage holders may be pitched credit card offers in an attempt to increase the customer's profitability to the bank. Other banks have attempted to emulate Wells Fargo's cross-selling practices . Fraudulent manipulation of foreign currency exchange rates erodes consumer trust in banking institutions and is a disincentive to do business with foreign entities. Whistleblowers are needed to prevent these harmful practices from becoming a norm, as this case shows how systematic deceptive practices became standard operating procedure for a company. The whistleblower received $1.6 million, the maximum award for a whistleblower in a successful FIRREA case.

Wells Fargo is an excellent bank for those looking for both local branch access and digital banking services. The bank's interest rates on most of its accounts leave a lot to be desired compared to the best online banks, but they are comparable to other national banks. The other Wells Fargo savings account is Platinum Savings. This account carries a $12 monthly service fee, which is waived by maintaining a $3,500 minimum daily balance each statement period.

Platinum Savings account holders can receive a complimentary debit card, a perk that isn't common with savings accounts. Wells Fargo also touts the use of your Way2Save account as a method of overdraft protection for customers who also have checking accounts. If you sign up for this optional service, Wells Fargo will transfer money from your Way2Save account into your checking account to cover an overdraft. However, this service doesn't prevent you from being charged a $12.50 overdraft fee once per business day. The fee can be avoided if a covering transfer or deposit is made on the same business day.

In addition, Wells Fargo automatically waives the monthly fee for account holders under the age of 24. Wells Fargo profited from these transactions by marking up the prices on currency it was selling to and marking down the prices on currency it was buying from its customers. These agreements, referred to internally as "fixed-pricing agreements," were both written and oral in nature.

Wells Fargo offers several other products and services outside of its personal deposit accounts. The bank offers many credit cards, including several popular rewards and cash back credit cards. Customers looking for a well-established and well-rounded financial institution may do well with Wells Fargo. Not only does this bank possess a large geographic footprint, but it also has every type of account, product and service you may need — a true one-stop banking shop. Add in the fact that you can enjoy some relationship bonuses for linking multiple accounts or products under the Wells Fargo umbrella and this institution is a clear winner for anyone who values efficiency and streamlined banking experience.

That said, Wells Fargo has not yet earned back the public's trust after the revelations from 2016 to 2018, of a series of systemic fraudulent practices that victimized its own clients for nearly two decades. If your branch is temporarily closed, please email with your request, your name, and the branch's city and state. A representative will reach out by phone or email within 2 business days to schedule an appointment for you to access your safe deposit box. Online banking customers deposit checks by snapping a picture, get their cash at ATMs and open new accounts from their phone or computer. And without having to pay to operate physical locations, online banks are often able to offer higher interest rates and lower fees on deposit accounts than their traditional competitors. Wells Fargo Bank agreed to pay a total of approximately $72.6 million in a civil fraud settlement with the United States to resolve allegations the financial institution fraudulently overcharged hundreds of commercial customers who used the bank's foreign exchange services.

Wells Fargo & Co. is a diversified, community-based financial services company. It is engaged in the provision of banking, insurance, investments, mortgage, and consumer and commercial finance. Daphne Foreman is the Banking and Personal Finance Analyst for Forbes Advisor. She has worked as a personal finance editor, writer, and content strategist covering banking, credit cards, insurance and investing. As a small business owner and former financial advisor, Daphne has first-hand experience with the challenges individuals face in making smart financial choices. 2Enrollment with Zelle through Wells Fargo Online® is required.

Transactions typically occur in minutes when the recipient's email address or U.S. mobile number is already enrolled with Zelle. Available to almost anyone with a U.S.-based bank account. For your protection, Zelle should only be used for sending money to friends, family, or others you know and trust. Sending money with Zelle is similar to making a payment in cash. The Request feature within Zelle is only available through Wells Fargo using a smartphone.

In order to send payment requests to a U.S. mobile number, the mobile number must already be enrolled with Zelle. For more information, view the Zelle® Transfer Service Addendum to Wells Fargo's Online Access Agreement. Fraudulent manipulation of foreign financial transactions is not a magic trick. The United States Department of Justice simultaneously filed andsettled a case against a major bank regarding deceptive practices resulting in higher fees for foreign transactions.

Under the terms of the settlement, Wells Fargo Bank, N.A. A whistleblower brought this matter to the Government's attention by filing a confidential declaration with the U.S. Department of Justice pursuant to the Financial Institutions Anti-Fraud Enforcement Act . About half of the settlement will be paid to affected customers as restitution and the remaining half will be paid to the government as civil penalties and asset forfeiture.

"We all put trust in our banking institutions to deal with us honestly, fairly and transparently when we are their customers. For the better part of a decade, Wells Fargo abused this trust, using tricks, false information and other deceptive practices to fraudulently overcharge customers who used the Bank's foreign exchange service," U.S. He aims to rebuild brand trust and re-establish its resiliency as it had surpassed different financial crises better than other banks.

Another savings encouragement is the Save As You Go® transfer, which moves $1 from your Wells Fargo checking account to your Way2Save account with each qualifying transaction. These transactions include any non-recurring debit card purchases and any time you pay a bill using the Wells Fargo online bill pay option. Poor, poor, poor customer service and highly understaffed. Definetly does not exist to provide customer service, just want to make money. I understand it's a business but years of mistreatment I've received from this bank made me so furious I will take my business somewhere else. From my personal experience, i highly suggest not banking at this location.

You really need to re-evaluate this branch and maybe even re-train your manager and CSR because this is bad for business. You give good customer service, in return not only will your customers come back but will "buy" into your products as well as recommend this branch. Until things change "there" at this branch, I will continue to persuade people to visit other locations. It's all about customer service and Wedgewood Plaza missed their mark by a long shot.

I have been banking at the same branch office for many years now. They know me by name, ask about my little girl, they see me every week, a place where 7 deposits a month go. I lost my wallet the other day and went to my local branch office where they know me. They called me by name when I walked in and shook my hand. I told them I lost my wallet and needed a new bank card.

He said oh to bad you will have to wait 7-14 days for a new card. Then he stated if I like he will get me $20 from my account so I can go get a new DL. They told me how to get money from my account without a bank card and also shipped me another cc overnight. I will never go to my local branch office again and will be closing all accounts with Well Fargo in the coming weeks because of the way I was treated at branch office.

Wells Fargo offers various accounts, like free checking, business accounts, college accounts, etc. I chose to go with Custom Management due to its adequate features and a lack of fees. I should note at this point that the account officially does come with.Wells Fargo offers secured personal loans that come with a lower interest rate than other personal loans. This is an option not offered by most other lenders for personal loans.

Wells Fargo offered foreign exchange services to commercial customers, many of which were small and medium-sized businesses. These services included converting foreign currency to U.S. dollars and vice versa. Wells Fargo FX sales specialists used a variety of misrepresentations and deceptive practices to defraud customers. For example, instead of applying agreed-upon fixed spreads to customers' outgoing wires, FX sales specialists would charge inflated spreads that were as large as the FX sales specialists thought they could get away with.

This practice was referred to internally as "Range of Day" Pricing. Online banks are typically better for low fees and higher APYs, though. Because online banks don't have to pay for physical branch locations, they can afford to charge less and pay more.

Technically, a national bank is a bank chartered by the US government. For the sake of our list, we considered a national bank to be one with an extensive network of bank branches and ATMs, or an online bank that's available nationwide. The company provides a wide range of products and services to corporations, financial institutions, supranationals, sovereigns, and agencies through branches and representative offices in more than 40 countries and territories. Wells Fargo & Company is an American international financial services company with a diversified set of company banking operations. It serves 11 million customers via more than 3,000 bank stores in the United States.

As mentioned earlier, Wells Fargo has an extensive local banking network, with more than 5,200 bank branches and 13,000 ATMs in the U.S. One thing to note is that with most deposit accounts, the bank charges a $2.50 ATM fee per transaction at non-Wells Fargo ATMs. If you need more personal banking attention, Wells Fargo offers wealth management and private banking services. The bank is also known for its small business and commercial banking solutions. Investopedia is dedicated to providing consumers with unbiased, comprehensive reviews of banks.

We collected more than 20 data points across more than 80 banks including products available, interest rates, fees and accessibility to ensure that our content helps users make the right decision for their savings and banking needs. The firm's primary subsidiary is Wells Fargo Bank, N.A., a national bank chartered in Wilmington, Delaware which designates its main office in Sioux Falls, South Dakota. It is the fourth largest bank in the United States by total assets and is one of the largest as ranked by bank deposits and market capitalization. Along with JPMorgan Chase, Bank of America, and Citigroup, Wells Fargo is one of the "Big Four Banks" of the United States. Wells Fargo offers foreign exchange hedging products and foreign currency management solutions through Wells Fargo Bank, N.A., which is a swap dealer registered with the Commodity Futures Trading Commission and a member of the National Futures Association. This information does not constitute investment advice or a recommendation or opinion to enter into any foreign exchange or other transaction.

Wells Fargo is one of the largest banks in the country, so it's no surprise that you're considering it during the search for your next checking account. The bank operates the most extensive branch and ATM network in the U.S., which is great from a convenience standpoint. Nowadays, traditional banking services can be provided digitally, substituting banks' physical presence with a cheaper online support. As a consequence, the number of bank branches in the United States decreased since 2009. The share of U.S. consumers relying on digital banking has increased steadily over time, in particular during the coronavirus pandemic.

Wells Fargo & Company is a public bank holding corporation which offers a diversified and dynamic set of financial services. It is world's fourth largest bank globally by market capitalization and the fourth largest bank in the United States by total assets. All of Wells Fargo's bank accounts come with monthly service fees. You may be better off banking elsewhere if you aren't confident you can meet monthly requirements to have the fees waived.

You'll have to weigh the cost of paying fees versus account benefits to see if it's worth banking with Wells Fargo. You can avoid some fees by taking advantage of the relationship benefits when you open multiple accounts. Wells Fargo offers several investment services, including self-directed and automated investing. Wells Fargo provides IRAs, mutual funds, rollover accounts and college savings accounts for retirement and education planning.

Platinum Savings is an interest-bearing savings account with the option to earn a bonus rate by pairing it with a Portfolio by Wells Fargo account. Both rates are low compared to what you can find at an online bank. Way2Save earns interest on all balances and features low variable rates in line with many national banks. Still, it's not competitive with the high-yield interest rates found with many online savings accounts. As the bank's premium checking account, Portfolio by Wells Fargo offers customers a number of major perks. At its core, the Portfolio account is an interest-bearing checking account, although the 0.01% APY is not currently impressive.

Expect a $25 per month maintenance fee, unless you maintain a minimum of $20,000 in your linked accounts at the end of each statement period. Are you looking for the nearest Wells Fargo bank around you? Information about the closest Wells Fargo branches and locations can be found below, as well as the phone number of the customer service department, info about the business hours and more relevant details.

Availability may be affected by your mobile carrier's coverage area. The bank has admitted its workers opened as many as 3.5 million fake accounts, and charged customers for auto insurance they didn't need and mortgage fees they didn't deserve. Wells Fargo has also been accused of ripping off mom-and-pop shops on credit card fees. Some experts predict bank branches are heading for extinction.