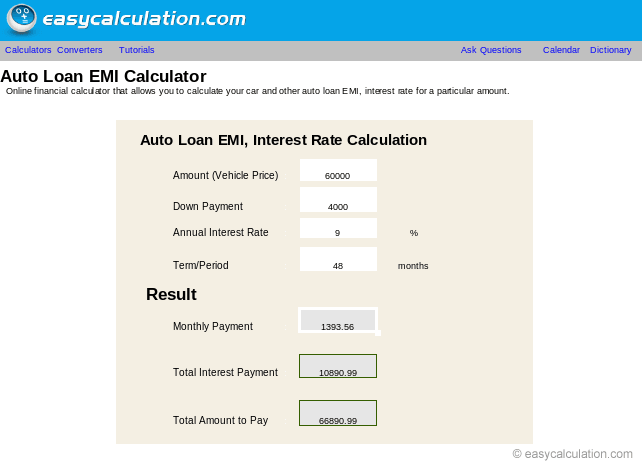

There are a lot of benefits to paying with cash for a car purchase, but that doesn't mean everyone should do it. Situations exist where financing with an auto loan can make more sense to a car buyer, even if they have enough saved funds to purchase the car in a single payment. It is up to each individual to determine which the right decision is. Use this calculator to help you determine your monthly car loan payment or your car purchase price.

After you have entered your current information, use the graph options to see how different loan terms or down payments can impact your monthly payment. You can also examine your complete amortization schedule by clicking on the 'View Report' button. You can also examine your complete amortization schedule by clicking on the "View Report" button.

Purchasing a vehicle usually requires a significant financial investment. Even a modestly priced vehicle—let's say $8,000 to $10,000—is more than most people can afford to pay with cash. Which means most people need to take out an auto loan in order to buy a car. If the individual simply wants another car to enhance their social status, careful consideration should be given to the costs of purchasing another vehicle. In addition to the purchase price and possibility of monthly payments, insurance costs may rise. For example, if the vehicle to be purchased is a newer model and it is financed through a bank or finance company, the owner will be required to carry full coverage insurance.

With an older vehicle that is paid off, the owner may carry liability only. Not only must the owner consider the possibility of the montly payment, or a larger payment, to their existing budget, they must also consider a rise in insurance premiums. Your loan term -- or the amount of time you'll be paying back the loan -- will impact the price of your monthly car payments.

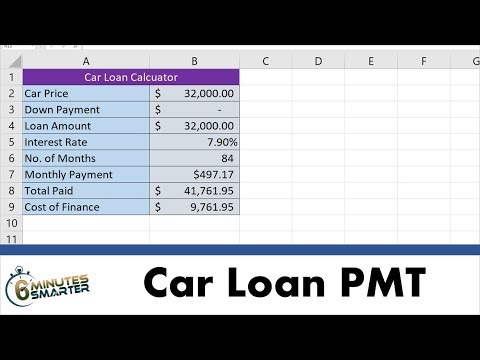

With a shorter-term auto loan, your monthly payments will be higher, but you will have a lower APR and pay less in interest in the long-run. Use the auto loan calculator to see the difference in monthly payments and interest paid depending on the term of the auto loan. The car loan calculator is a tool that does more than just show you a monthly car loan payment.

Use it to compare lender offers and try different interest rates and loan terms. The knowledge you gain can help you negotiate with lenders and dealers and ultimately choose the best auto loan for your financial situation. Bankrate's auto loan calculator will give you a good idea of how much car you can afford from a monthly payment standpoint. Start with a list of vehicles that you're interested in and estimated purchase prices.

Then subtract the amount of money you can use for a down payment and an estimate of your current car's trade-in value. Lastly, compare costs to make sure that the calculated auto loan payment based on the amount you need to borrow aligns with your monthly budget. The best way to lower your vehicle payment is to put money down when you initiate the deal.

For example, if you're buying a $20,000 vehicle, your auto loan would be for $20,000, plus whatever the interest is. But with a $4000 down payment, you'll only have to take out a $16,000 loan, plus interest. The benefit here, aside from a lower sale price, is that you will have lower monthly payments. Try using different down payments in the car loan calculator Canada! An auto loan calculator shows the total amount of interest you'll pay over the life of a loan.

If the calculator offers an amortization schedule, you can see how much interest you'll pay each month. With most car loans, part of each payment goes toward the principal , and part goes toward interest. Buying any new or used car can get overwhelming when you have no clue of where to begin from the money standpoint.

One of the keys to a successful car purchase has always been being able to figure out what you can manage financially. So, to that end, use our car loan calculator to get an idea of what you can afford! All you have to do is plug in your desired monthly payment or your desired vehicle price. As a business, a car finance solutions may help you improve cash flow to your business, as well as the potential to claim tax deductions if the car is being used for business purposes . Just like with insurance, shopping around for good loan rates will save buyers a great deal of money on their loan. The lower the interest rate, the lower the overall cost of purchasing.

Better still, if the purchaser is able to pay cash, they will not need a loan. This, however, requires that the purchaser save aggressively before embarking upon the purchase. Buyers who pay in full will have the option to carry liability or full coverage insurance and the buyer will only pay the price for the vehicle. They will pay no interest charges or fees associated with a loan.

Clearly, saving in advance and paying cash is the best way to buy. Your monthly car payment is based on the loan amount, the loan term and the interest rate for the loan. Loan amount is based on the net purchase price of the vehicle or the vehicle price less any cash rebate, trade-in or down payment.

If you have an outstanding balance on the vehicle you trade-in, that amount is added to the price of the vehicle you are purchasing. Use this calculator to help you determine the monthly loan payment for your car, truck, boat, RV or motorcycle. Enter purchase price, monthly payment, down payment, term and interest rate to see how different loan terms or down payments can impact your monthly payment. A car purchase comes with costs other than the purchase price, the majority of which are fees that can normally be rolled into the financing of the auto loan or paid upfront.

However, car buyers with low credit scores might be forced into paying fees upfront. The following is a list of common fees associated with car purchases in the U.S. However, most people are not prepared to pay the full purchase price in cash when they buy, financing at least some portion of the vehicle. Still, a large downpayment will minimize the loan and keep monthly payments down. For those who must finance their vehicles, taking a few months to clean up any credit problems before applying for the loan is advisable.

Obtain credit reports from all three credit reporting agencies, which you can do for free at AnnualCreditReport.com. Challenge any information that is not recognized or verifiable. The company that has placed the entry on the credit report has 30 days to respond to a challenge with proof that the creditor owes them what the entry claims. If the company does not respond within 30 days, the entry is removed from the credit report. Use our auto loan calculator to estimate your monthly car loan payments.

Enter a car price and adjust other factors as needed to see how changes affect your estimated payment. Total purchase price This is the total cost of your auto purchase. Include the cost of the vehicle, additional options and destination charges.

Sales tax will be calculated for you and included in your total after-tax price. Many variables, including current market conditions, your credit history and down payment will affect your monthly payment and other terms. See your local dealer for actual pricing, annual percentage rate , monthly payment and other terms and special offers. Pricing and terms of any finance or lease transaction will be agreed upon by you and your dealer. The factor that will change your monthly payment the most is the loan term. The longer your loan, the less you'll pay each month, because you're spreading out the loan amount over a greater number of months.

However, due to the interest you'll be paying on your loan, you'll actually end up spending more for your vehicle by the time your payments are over. Because the more time you spend paying off your loan, the more times you will be charged interest. The Auto Loan Calculator is mainly intended for car purchases within the U.S. People outside the U.S. may still use the calculator, but please adjust accordingly. If only the monthly payment for any auto loan is given, use the Monthly Payments tab to calculate the actual vehicle purchase price and other auto loan information. Once credit reports are cleaned up, the buyer should shop the loan around to various banks and finance companies.

With good credit, the purchaser will be more likely to obtain a low interest rate for the loan. Generally speaking, the lower the amount borrowed & the shorter the loan term, the less interest you have to pay on a loan. If you're planning on financing your new vehicle purchase, the overall price of the vehicle isn't really the number you need to pay attention to. Because, as our auto loan calculator will show you, the price you ultimately end up paying depends on how you structure your deal. Use this car finance calculator to calculate monthly, fortnightly or weekly repayment options.

You can structure your car finance calculation based on a specified interest rate, loan term in month or years, amount borrowed and a residual value . They work as any generic, secured loan from a financial institution does with a typical term of 36, 60, 72, or 84 months in the U.S. Each month, repayment of principal and interest must be made from borrowers to auto loan lenders.

Money borrowed from a lender that isn't paid back can result in the car being legally repossessed. The auto loan calculator will display your estimated monthly auto payment. You will also see the total principal paid and the total interest paid. Add these two figures together to see the total amount you will pay for your new or used car over the life of the loan. Enter the amount you need to finance your car into the auto loan calculator. To calculate this, subtract your down payment and trade-in value amounts from your car's sticker price or MSRP.

Enter a total loan amount into this auto loan calculator to estimate your monthly payment, or determine your loan amount by car price, trade-in value and other factors. We offer financing options for new or used cars, SUVs, trucks, vans and recreational vehicles that are sold privately or through dealerships. Try our vehicle loan calculator to see how much your monthly payments could be. Use our car loan calculator to see what your monthly payment might look like—and how much interest you would pay over the life of the loan. Any calculation made by you using this Car Loan calculator is intended as a guide only.

It is for illustrative purposes only and is based on the accuracy of the information provided. The calculator does not take establishment fees, stamp duty or other government charges into account. The amount you can borrow may vary once you complete a loan application and all the details relevant to our lending criteria are captured and verified. The calculations should not be relied on for the purpose of making a decision whether to apply for a car loan. The buyer may locate a desired make and model, purchase insurance and apply for loans right from the site. Sites like TrueCar show the user the amount others have paid for the make and model they are searching for.

Many people may prefer haggling over email or simply comparison shopping for a good selling price instead of haggling in person with a salesperson or a seller over their asking price. No matter the preference of the buyer, they should try to obtain the lowest selling price for the vehicle they choose. Online alternatives make the process less personal and more efficient.

Use such sites to see what others are paying for the same make and model regardless of comfort level of face-to-face haggling. Some people may simply be intimidated with the prospect of being on the seller's own turf when attempting to negotiate. Sites like CarsDirect and Truecar level the playing field and ensure that the dealer or seller is not able to influence the buyer as with a face-to-face interaction. No matter if the buyer purchases new or used, the car will need to be insured.

If the buyer purchases with cash and no portion of the purchase price is financed, the new owner may carry liability only insurance. However, depending on the vehicle age, buyers who pay in full upfront may still want to consider full coverage. When an individual buys a car, they are typically buying the transportation they will rely on for years to come. For most people this is a major investment, second only to the purchase of a home. After all, few people have the resources or options to upgrade their vehicle often.

The average auto loan hit a record of $31,455 in the first quarter of 2018, with the average used car loan running $19,708. Americans have over $1 trillion in motor vehicle credit outstanding.The following table from Experian shows how much people with various credit ratings typically are charged for loans. The best way to get a lower auto loan interest rate is to improve your credit score. If you have a low credit score, consider holding off on a car purchase until you can improve your score.

It is the monthly payment amount that you must pay each month to the bank or finance company. When a vehicle is financed, the monthly payment includes taxes. This is the amount of time a loans repayment is scheduled over. Typically a longer loan term means a buyer will have a lower monthly payment, but will pay more in interest over time. This figure represents the cars sticker price or negotiated price, this is the price that the seller and buyer have agreed upon for purchase of the car.

This figure does not include sales tax or the cost of financing the loan. Know that there isn't one "best" way to get the lowest monthly payment. It depends on your trade-in value, your credit history, your desired term, how much your willing to put down at the time of purchase, etc. If you're on a tighter budget, then choosing the lowest payment possible could be the best way to go. However, if you're able to pay more each month, then you'll be able to take a shorter term and have your vehicle paid off faster .

Avoid Overbuying—Paying in full with a single amount will limit car buyers to what is within their immediate, calculated budget. To complicate matters, car salesmen tend to use tactics such as fees and intricate financing in order to get buyers to buy out of their realm. Probably the most important strategy to get a great auto loan is to be well-prepared.